Nebraska Property Tax Deduction . The credit is available for both school district and community college property. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. how do property tax credits affect the allowable school district and community college property taxes on a parcel? here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. credit for property taxes paid in 2022 and after. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they.

from www.templateroller.com

credit for property taxes paid in 2022 and after. taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. The credit is available for both school district and community college property. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. how do property tax credits affect the allowable school district and community college property taxes on a parcel? here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here.

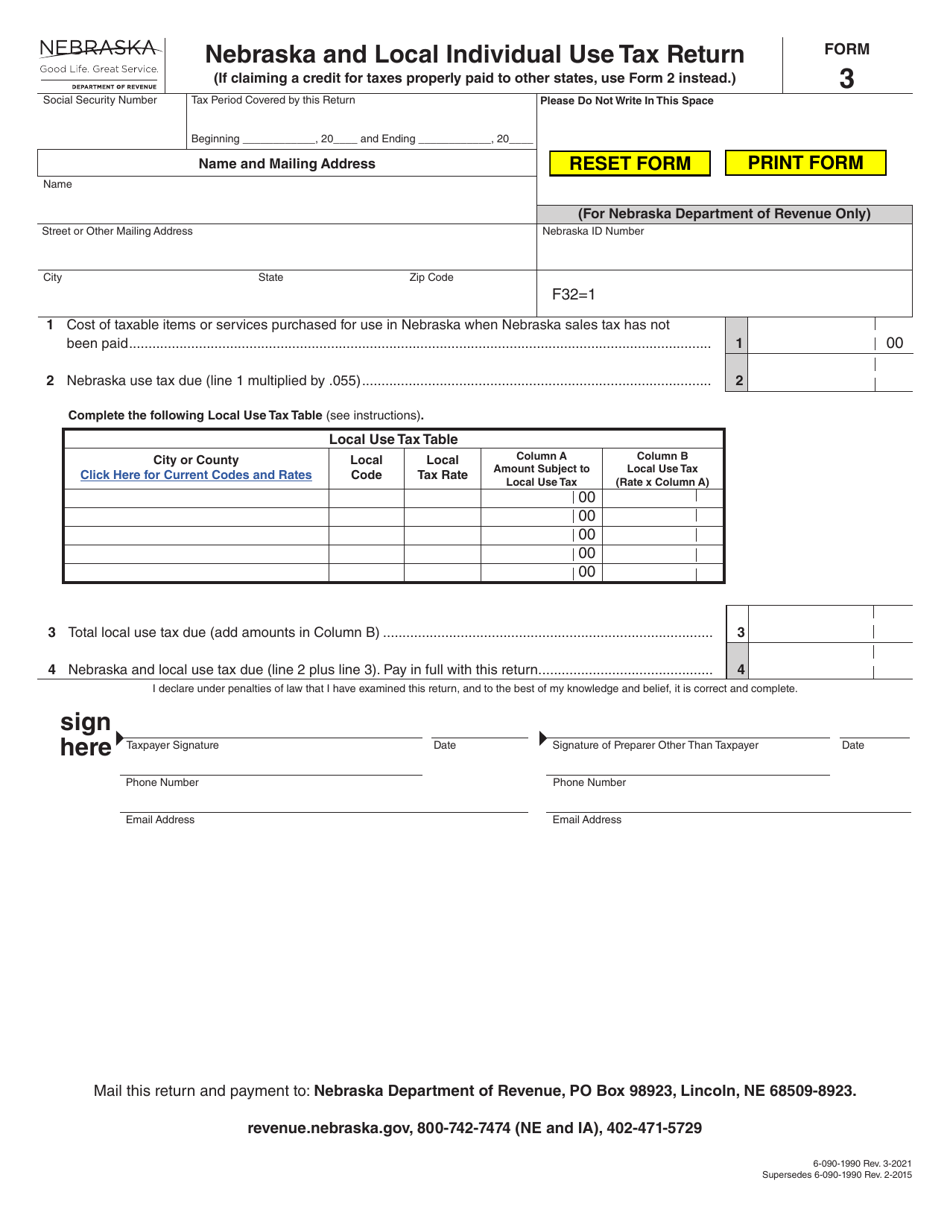

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

Nebraska Property Tax Deduction credit for property taxes paid in 2022 and after. credit for property taxes paid in 2022 and after. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. The credit is available for both school district and community college property. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. how do property tax credits affect the allowable school district and community college property taxes on a parcel? taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid.

From www.3newsnow.com

Property tax petition drive gaining momentum in Nebraska Nebraska Property Tax Deduction taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. The credit is available for both school district and community college property. here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. how do. Nebraska Property Tax Deduction.

From www.taxuni.com

Nebraska Property Tax Nebraska Property Tax Deduction taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. how do property tax credits affect the allowable school district and community college property taxes on a parcel? (ap) — nebraska taxpayers who want to. Nebraska Property Tax Deduction.

From www.templateroller.com

Form PTCX 2021 Fill Out, Sign Online and Download Fillable PDF Nebraska Property Tax Deduction credit for property taxes paid in 2022 and after. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. how do property tax credits affect the allowable school district and community college property taxes on a parcel? taxpayers are reminded to claim their refundable credits for school district and community. Nebraska Property Tax Deduction.

From www.taxuni.com

Nebraska Property Tax Nebraska Property Tax Deduction here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. The credit is available for both school district and community college property. nebraska farm bureau estimates. Nebraska Property Tax Deduction.

From www.mortgagerater.com

Nebraska Property Tax Relief Explained Nebraska Property Tax Deduction (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more. Nebraska Property Tax Deduction.

From www.youtube.com

How do I look up property taxes in Nebraska? YouTube Nebraska Property Tax Deduction nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. The credit is available for both school district and community college property. credit for property taxes paid in 2022 and after. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. how do property tax. Nebraska Property Tax Deduction.

From platteinstitute.org

50 million in Nebraska property tax relief goes unclaimed, total may rise Nebraska Property Tax Deduction how do property tax credits affect the allowable school district and community college property taxes on a parcel? nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. here’s a video from the nebraska department. Nebraska Property Tax Deduction.

From platteinstitute.org

Nebraska community college property tax repeal simplifying the tax Nebraska Property Tax Deduction The credit is available for both school district and community college property. nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. taxpayers are reminded to. Nebraska Property Tax Deduction.

From www.wowt.com

Nebraska officials review state’s new property tax relief package Nebraska Property Tax Deduction taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. how do property tax credits affect the allowable school district and community college property taxes on a parcel? here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form,. Nebraska Property Tax Deduction.

From platteinstitute.org

This Time, It’s Personal Nebraska’s Personal Property Tax Nebraska Property Tax Deduction nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. how do property tax credits affect the allowable school district and community college property taxes on a parcel? taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. credit for property taxes paid. Nebraska Property Tax Deduction.

From www.openskypolicy.org

“Real Taxpayers of Nebraska” and increasing the property tax credit Nebraska Property Tax Deduction The credit is available for both school district and community college property. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. here’s a video from the nebraska department of revenue on how. Nebraska Property Tax Deduction.

From www.youtube.com

Nebraska Property Tax Incentive Act YouTube Nebraska Property Tax Deduction credit for property taxes paid in 2022 and after. how do property tax credits affect the allowable school district and community college property taxes on a parcel? nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. The credit is available for both school district and community college property. nebraska farm. Nebraska Property Tax Deduction.

From www.nefb.org

Don’t to Claim the Property Tax Credit Nebraska Farm Bureau Nebraska Property Tax Deduction (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. how do property tax credits affect the allowable school district and community college. Nebraska Property Tax Deduction.

From platteinstitute.org

Nebraska’s Crowded Budget and its Impact on Property Taxes Nebraska Property Tax Deduction The credit is available for both school district and community college property. here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. how. Nebraska Property Tax Deduction.

From www.templateroller.com

Form 3 Download Fillable PDF or Fill Online Nebraska and Local Nebraska Property Tax Deduction nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. taxpayers are reminded to claim their refundable credits for school district and community college property taxes paid. The credit is available for both school district and community college property. credit for property taxes paid in 2022 and after. here’s a video. Nebraska Property Tax Deduction.

From www.pinterest.com

Nebraska Property Tax Calculator Property tax Nebraska Property Tax Deduction nebraska homeowners can expect property tax credits to be automatically applied to their tax bill,. The credit is available for both school district and community college property. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. (ap) — nebraska taxpayers who want to claim an income tax credit for some of. Nebraska Property Tax Deduction.

From nebraska.tv

Governor Pillen discusses Nebraska's property tax crisis in Scottsbluff Nebraska Property Tax Deduction how do property tax credits affect the allowable school district and community college property taxes on a parcel? here’s a video from the nebraska department of revenue on how the program works, and how to complete the necessary tax form, with more info here. taxpayers are reminded to claim their refundable credits for school district and community. Nebraska Property Tax Deduction.

From revenue.nebraska.gov

Nebraska Property Tax Credit Nebraska Department of Revenue Nebraska Property Tax Deduction (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they. credit for property taxes paid in 2022 and after. nebraska farm bureau estimates the credit, when combined with the tier 1 property tax credit program,. nebraska homeowners can expect property tax credits to be automatically applied to their. Nebraska Property Tax Deduction.